- TOP

- Sustainability

- Action on Climate Change

Action on Climate Change

--Disclosure Based on the TCFD Recommendations

Basic Approach

At the NLM Group, we fully recognize the impact that our business activities may have on the environment. We have established a basic environmental policy, under which we are taking initiatives to realize sustainable businesses and a sustainable society voluntarily and proactively, beyond complying with related laws and regulations. We have identified action on climate change as one of the NLM Group's material issues. We will strive to enhance the content of the information we disclose in accordance with the TCFD recommendations.

Governance

Positioning action on climate change as one of its most important management issues, the NLM Group formulates and implements sustainability promotion plans under the leadership of the "Group Environmental Committee" (which meets twice a year) and the "Group CSR Committee" (which meets twice a year), chaired by the President. The President is responsible for overseeing climate-related risks and opportunities, and the top management is personally leading the response to sustainability issues.

The Board of Directors regularly monitors and oversees progress against goals and targets set to address climate-related matters through reports from the committees, and considers climate-related risks and opportunities as an important factor in decision-making, risk management processes, and oversight of related policies. The Board also appropriately discloses the status of its response.

In order to support the management in overseeing climate-related risks and opportunities, the Group CSR Committee, the Group Environmental Committee, and the Green Growth Strategy Office work in collaboration with relevant internal functions to continuously evaluate and improve the status of their response through prescribed control procedures such as KPI monitoring, internal reviews, and risk assessment processes. These controls are integrated as part of the company-wide risk management framework and are reflected in management decisions and reporting to the Board of Directors.

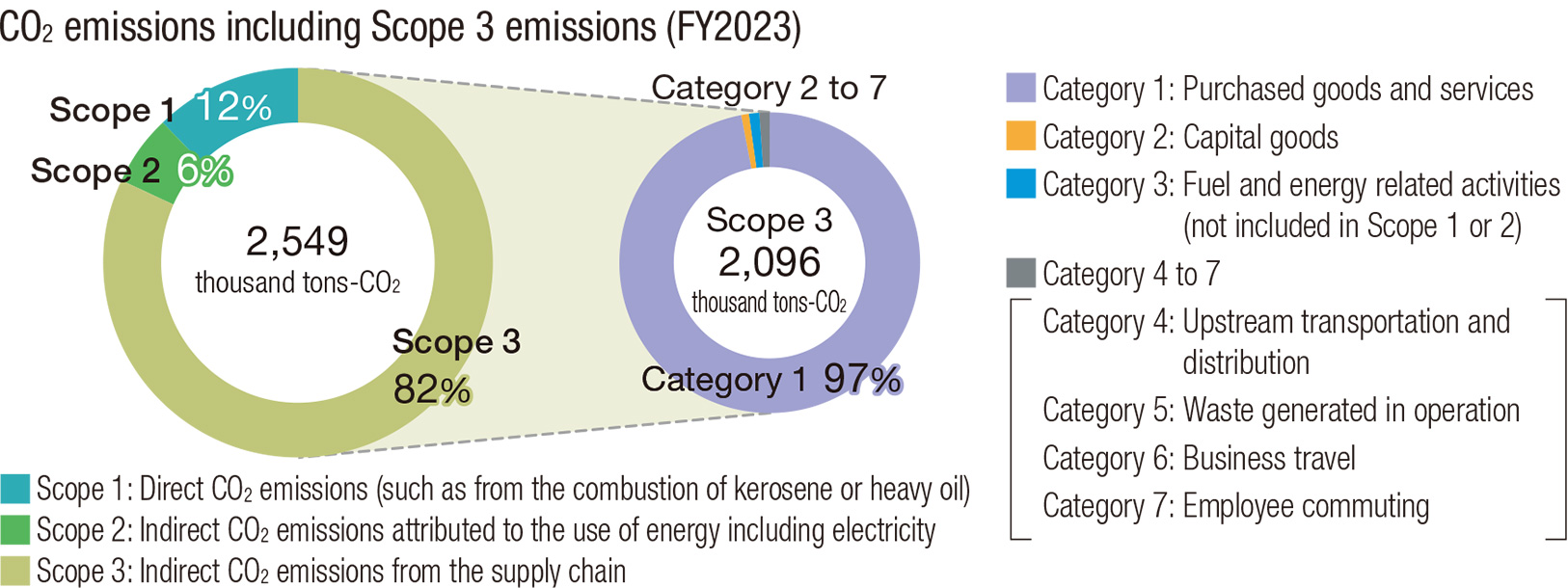

Changes in Greenhouse Gas Emissionsbr

(Scopes 1, 2 and 3), Indicators, and Targets

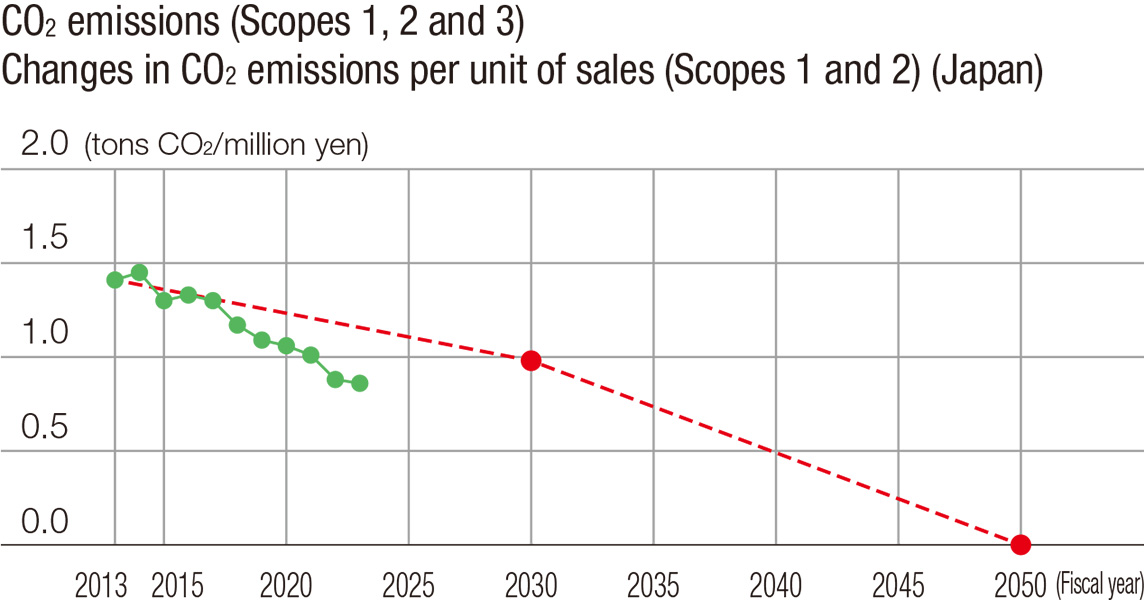

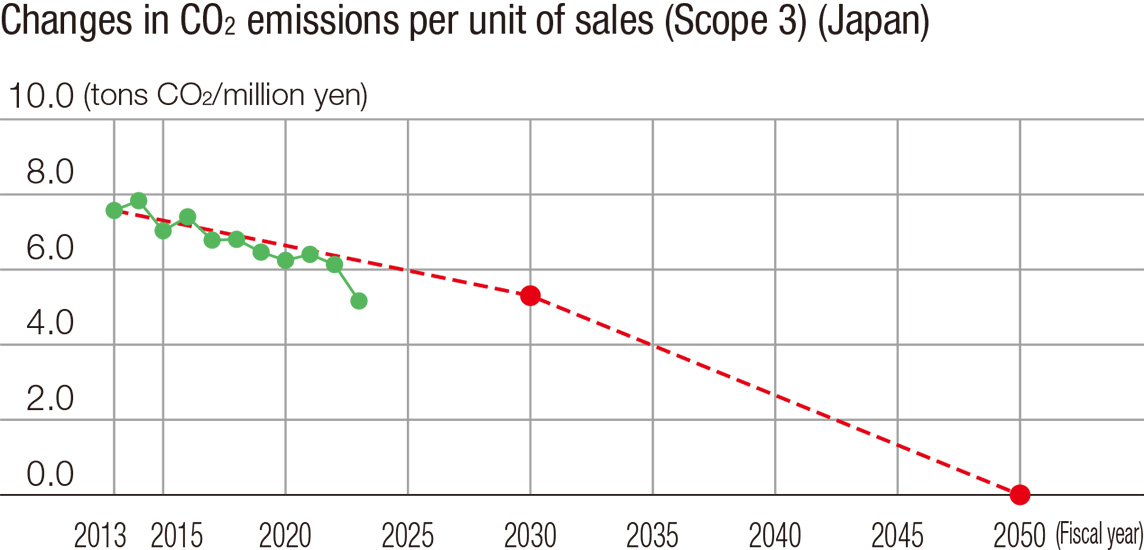

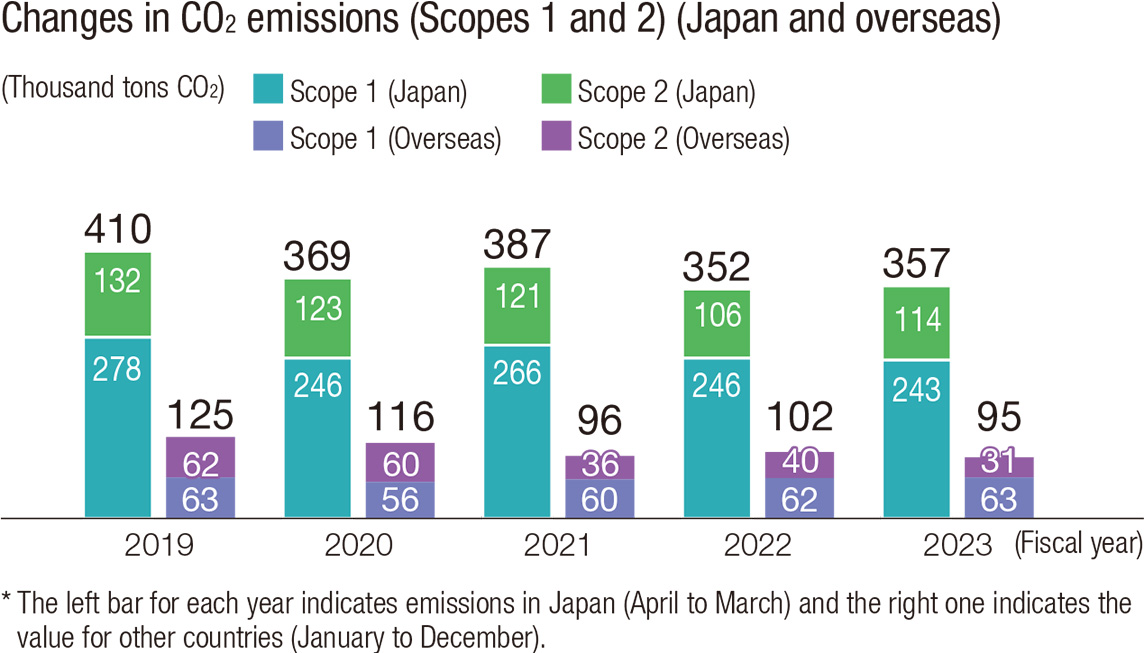

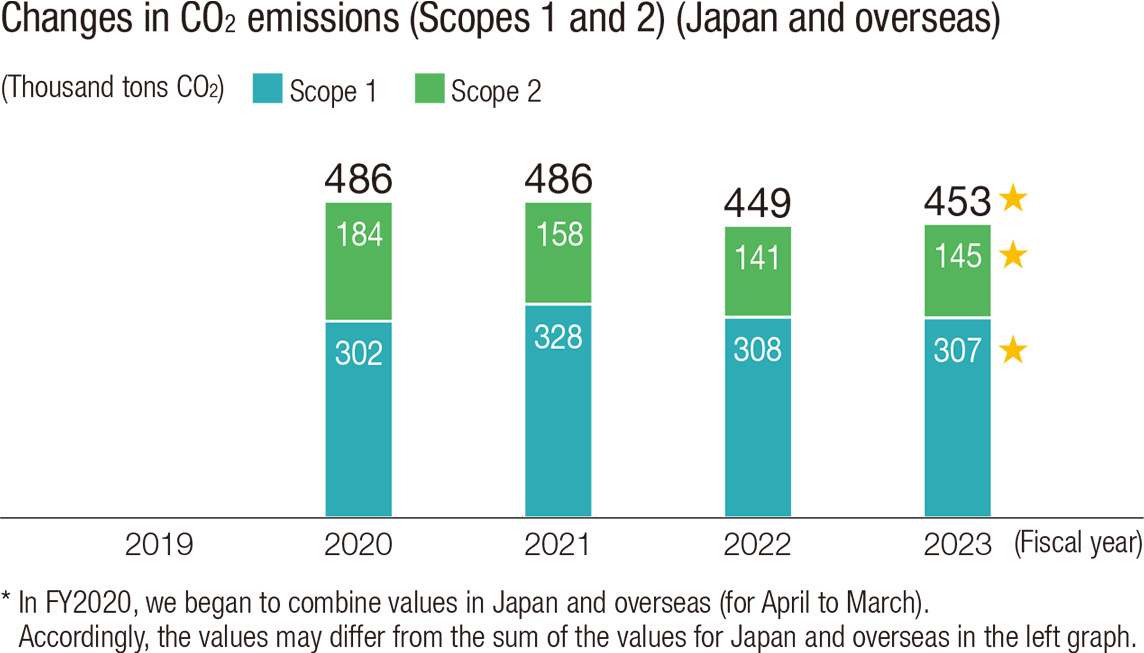

The NLM Group sets and calculates every year greenhouse gas emissions (Scope 1, 2, and 3) as an indicator for managing its climate change-related initiatives, and will improve the accuracy of calculations. We will continue to work to reduce greenhouse gas emissions so that greenhouse gas emissions (emissions per unit of sales) in 2030 will be 30% lower than the level in FY2013 (Scopes 1 + 2: 1.41 tons-CO2/million yen, Scope 3: 7.58 tons-CO2e/million yen), with the goal of achieving carbon neutrality by 2050.

In FY2024, greenhouse gas emissions per unit of sales decreased from the previous fiscal year for both Scopes 1 + 2 and Scope 3

* Boundary: 32 consolidated subsidiaries in Japan/13 overseas consolidated subsidiaries

* Greenhouse gas emissions (Scopes 1 and 2) are calculated in accordance with the Act on Rationalization of Energy Use and Shift to Non-fossil Energy and the Act on Promotion of Global Warming Countermeasures for Japan, and the GHG Protocol for overseas, and the following emission factors are used. / Electricity in Japan: Adjusted emission factor for each electric power supplier announced by the Ministry of the Environment and the Ministry of Economy, Trade and Industry/Electricity overseas: The emission factor announced by each government (since FY2023)/Fuel-city gas: Basic emission factor for each gas business operator announced by the Ministry of the Environment and the Ministry of Economy, Trade and Industry; Fuel-others: The emission factor per unit for each fuel set by a ministerial ordinance from the Ministry of the Environment

* Greenhouse gas emissions (Scope 3) is calculated in accordance with the GHG Protocol.

* Actual values of Scope 1 only relate to energy-derived CO2 emissions.

Strategy

To disclose information in accordance with the TCFD recommendations, the NLM Group conducts analyses based on two scenarios to clarify the difference in the impact between the scenarios. One is the 4.0°C scenario which assumes that climate change will not be addressed. The other is the 1.5°C scenario, which assumes that the strongest regulations will be imposed. The target years we have set are FY2030, a medium-term future for which we can be confident that the analysis results are accurate to a certain degree, and FY2050, a long-term future when the impact of climate change is expected to be more remarkable.

As the NLM Group has a wide range of business fields, we have not yet reached the point of analyzing all segments. In FY2025, however, by adding Toyo Aluminium K.K. to the scope, the NLM Group has all of its major domestic group companies in the scope. We then re-examined climate-related risks and opportunities across the entire value chain and extracted items that we assumed would have a major impact on the company.

We projected what the world will be like in the 4°C and 1.5°C scenarios in FY2030 and FY2050 based on reference materials from external sources and listed risks and opportunities that may occur there.

| 1.5°C scenario | 4°C scenario | |

|---|---|---|

| Assumed details | A scenario that assumes that policies and regulations aimed at decarbonization will be introduced and technology development will progress in order to limit the rise in global average temperature to 1.5°C above pre-industrial levels by the end of the 21st century. | A scenario in which the global average temperature at the end of the 21st century rises by 4°C above pre-industrial levels, resulting in an increase in physical damage caused by typhoons, etc. It is assumed that policies, regulations, and technology development will remain unchanged. |

| Referenced scenarios* | ・IEA Net Zero Emissions(NZE) ・IPCC SSP 1-1. |

・IEA Stated Policies Scenario(STEPS) ・IPCC SSP 5-8.5 Scenario |

- IEANZE...A scenario equivalent to 1.5°C published by the International Energy Agency (IEA). A scenario in which net zero is achieved by 2050.

- IEA STEPS...A scenario equivalent to 4°C published by the International Energy Agency (IEA). A scenario in which existing policies remain unchanged with no additional measures.

- IPCC...Abbreviation of "Intergovernmental Panel on Climate Change"

- IPCC SSP 1-1.9...A scenario equivalent to 1.5°C by IPCC. Greenhouse gas emissions will be net zero around 2050, and the temperature rise will be limited to 1.5°C as of the end of the 21st century.

- IPCC SSP 5-8.5...A scenario equivalent to 4°C by IPCC. It is assumed that greenhouse gas emissions and average temperatures will continue to rise, with temperatures rising by more than 4°C toward the 21st century.

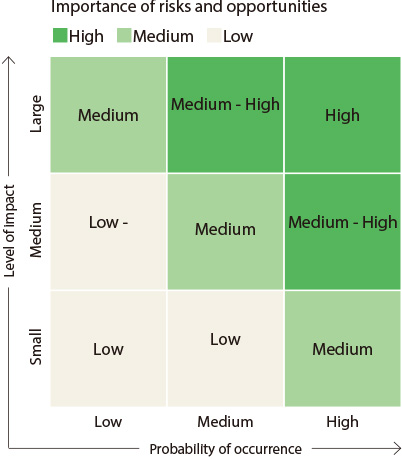

| Category | Description of the risk/opportunity in the scenario | Financial impact* | Degree of importance (probability of occurrence x impact) |

|||||

|---|---|---|---|---|---|---|---|---|

| FY2030 | FY2050 | |||||||

| 4.0℃ | 1.5℃ | 4.0℃ | 1.5℃ | |||||

| Risks | Transition | Policy and regulatory risks |

Increase in the cost of raw materials and production resulting from the introduction of carbon pricing (procurement) | High | Medium | Large | Large | Large |

| Increase in the cost of raw materials and production resulting from the introduction of carbon pricing (production) | Medium-High | Small | Medium | Medium | Large | |||

| Technological risks | Decline in competitiveness resulting from delays in responses to recycling regulations and technological developments | Low-Medium | Small | Medium | Medium | Large | ||

| Increase in the cost of investment, such as investments for the development of new recycling technologies | Low | Medium | Medium | Medium | Large | |||

| Market risks | Increase in the cost of raw materials resulting from an increase in scrap prices | Low-Medium | Small | Large | Large | Large | ||

| Increase in financing costs reflecting the decarbonization policies of shareholders and financial institutions | Low | Small | Small | Small | Medium | |||

| Shrinkage of the aluminum market resulting from an increase in materials that are alternatives to aluminum | Low-Medium | Small | Small | Medium | Large | |||

| Decline in sales of materials for gasoline vehicles resulting from the popularization of EVs | Medium | Medium | Large | Large | Large | |||

| Physical | Acute | Suspension of operations due to floods and storm surges | Medium | Small | Small | Medium | Small | |

| Chronic | Decline in labor efficiency and increase in the cost of labor resulting from rising temperatures | Low-Medium | Small | Small | Medium | Small | ||

| Opportunities | Transition | Products and services | Increase in sales of our products for electrified products (the popularization of EVs in particular) | Medium-High | Medium | Large | Large | Large |

| Increase in demand for other products related to decarbonization and energy conservation | Low-Medium | Small | Small | Small | Medium | |||

| Resource efficiency | Growth in demand for aluminum as a material with high recyclability | Low-Medium | Small | Small | Medium | Large | ||

* High: 10 billion yen or more, medium: 1 billion yen or more, low: less than 1 billion yen

In future climate change scenarios, it is expected that the proportion of environmentally compatible vehicles in automobile sales and manufacturing will increase. This will not only increase the need for weight reduction to extend running distance, but also increase demand for product groups such as components for batteries themselves of environmentally compatible vehicles and heat dissipation components for cooling.

Further, the value of products with high recyclability is expected to increase more as society moves toward the promotion of carbon neutrality. We believe that contributing to a recycling-oriented society will increase corporate value.

In this fiscal year, we included Toyo Aluminium K.K. in our analysis. Since the company also uses aluminum as its primary raw material, it was determined that the evaluation trends for risks and opportunities are similar to those of the existing segments analyzed. Therefore, the evaluation results were the same as that of last fiscal year.