- TOP

- Sustainability

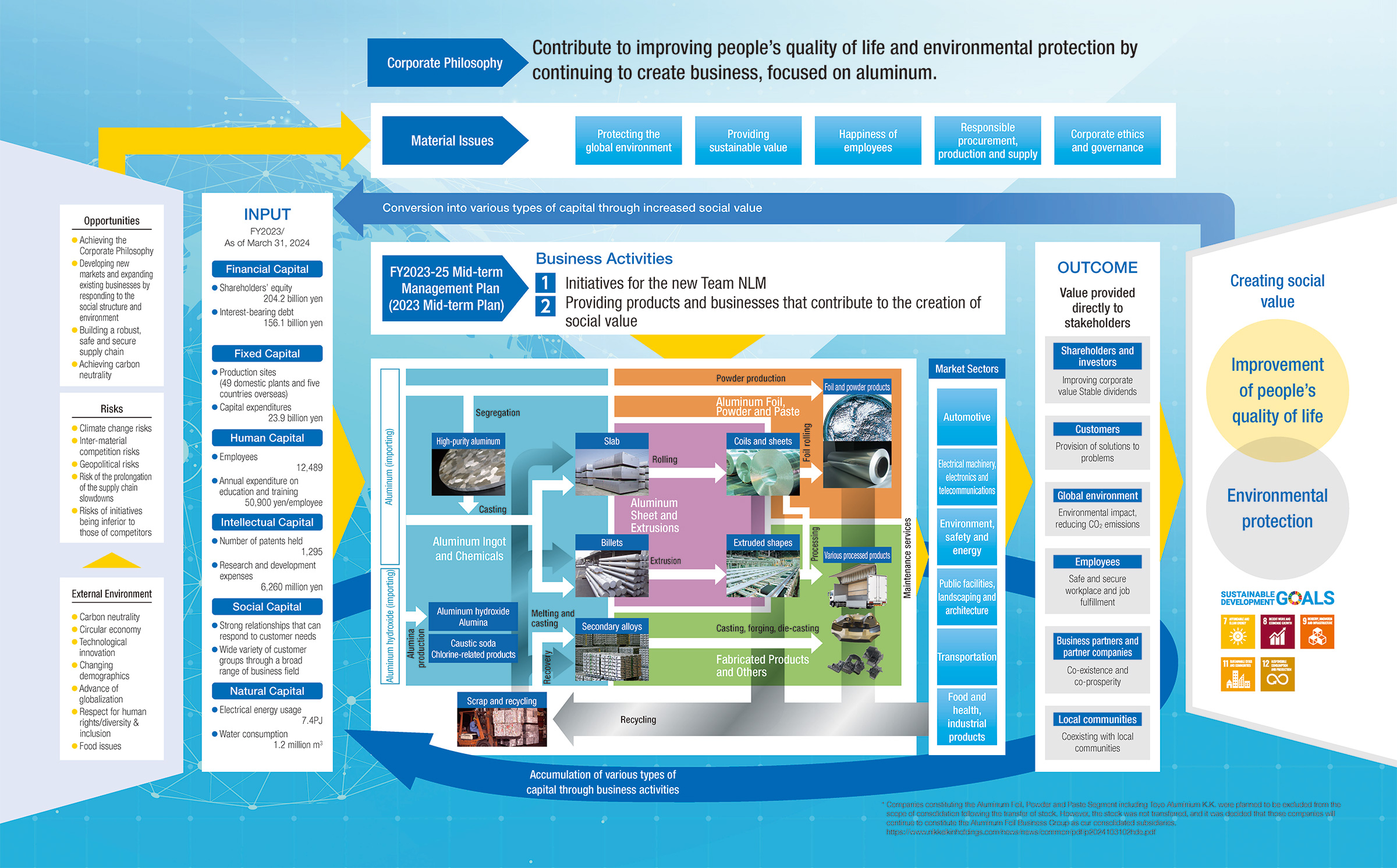

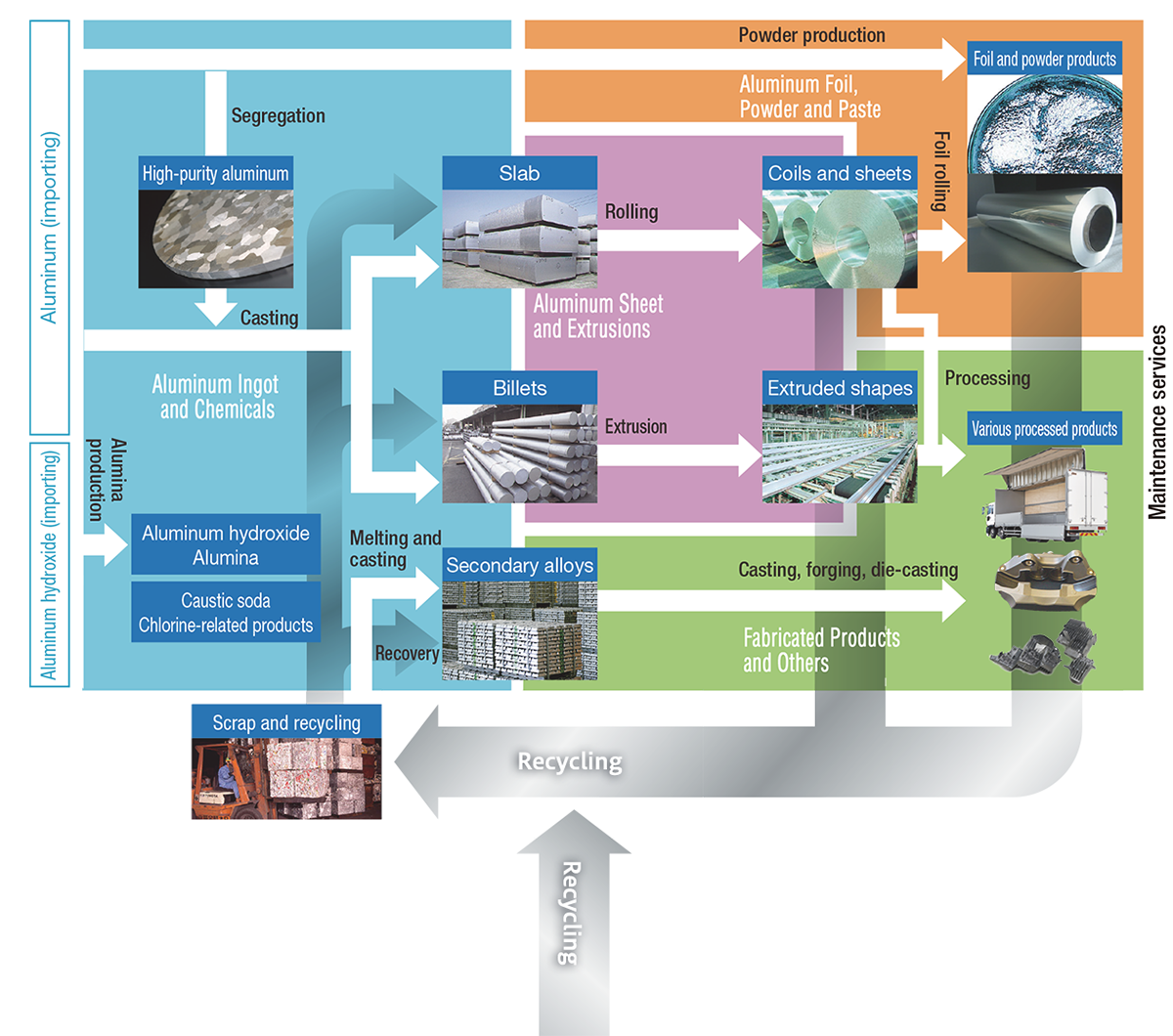

- The Value Creation Process

The Value Creation Process

Based on its Management Policy, the NLM Group aims to solve a range of material issues under the slogan of "as Team NLM, becoming a groundbreaking innovator of aluminum and beyond." We will invest both financial and non-financial capital in a wide range of businesses and contribute to the improvement of people's quality of life and environmental protection through the circulation of capital that is achieved by providing value to each stakeholder and creating social value.

Corporate Philosophy

Contribute to improving people's quality of life and environmental protection by continuing to create business, focused on aluminum.

Material Issues

External Environment

- ❶ Carbon neutrality

- ❷ Circular economy

- ❸ Technological innovation

- ❹ Changing demographics

- ❺ Advance of globalization

- ❻ Respect for human rights/diversity & inclusion

- ❼ Food issues

Opportunities

- A chieving the Corporate Philosophy

- Developing new markets and expanding existing businesses by responding to the social structure and environment

- Building a robust, safe and secure supply chainv

- Achieving carbon neutrality

Risks

- Climate change risks

- Inter-material competition risks

- Geopolitical risks

- Risk of the prolongation of the supply chain slowdowns

- Risks of initiatives being inferior to those of competitors

- Protecting the global environment

- Providing sustainable value

- Happiness of employees

- Responsible procurement,

production and supply - Corporate ethics and governance

Creating social value

INPUT

- Financial Capital

- Shareholders' equity 204.2 billion yen

- Interest-bearing debt 156.1 billion yen

- Human Capital

- Employees:12,489

- Annual expenditure on education and training 50,900 yen/employee

- Social Capital

- Strong relationships that can respond to customer needs

- Wide variety of customer groups through a broad range of business field

- Fixed Capital

- Production sites (49 domestic plants and five countries overseas)

- Capital expenditures:23.9 billion yen

- Intellectual Capital

- Number of patents held:1,295

- Research and develop-ment expenses:6,260 million yen

- Natural Capital

- Electrical energy usage:7.4PJ

- Water consumption:1.2 million m3

FY2023/ As of March 31, 2024

Business Activities

FY2023-25 Mid-term Management Plan

- ❶ Initiatives for the new Team NLM

- ❷ Providing products and businesses that contribute to the creation of social value

Market Sectors

- Automotive

- Electrical machinery, electronics and telecommunications

- Environment, safety and energy

- Public facilities, landscaping and architecture

- Transportation

- Food and health, industrial products

OUTCOME

Value provided directly to stakeholders

- Shareholders and investors

- Improving corporate value Stable dividends

- Global environment

- Environmental impact, reducing CO2 emissions

- Business partners and partner companies

- Co-existence and co-prosperity

- Customers

- Provision of solutions to problems

- Employees

- Safe and secure workplace and job fulfillment

- Local communities

- Coexisting with local communities

Creating social value